Précis

This post is mostly the story of my year in crypto, and of how I came to understand that continuing to work in the crypto biz was incompatible with my personal values. There is also a short preliminary discussion of how it happens that I’m posting this story today.

“My Crypto Journey,” below, started out as a memorandum to myself — a diary entry, in other words — which I wrote around a year after that journey had ended. I spent an hour or two today cleaning it up & adding some pictures. So that’s all this essay is, a somewhat gussied-up diary entry about a technical writing gig I had a few years ago. It is not a crypto primer, nor is it closely argued brief on why crypto sucks. If you’re looking for somebody to explain the cryptoverse to you, or if you’re looking for a debate about crypto’s merits, I’m not your guy.

This post contains a lot of technical jargon. If you have absolutely no familiarity with this stuff you may find it too dense to be worth your while. However if you just mentally substitute [mumble] for any word or concept you don’t know, I think you’ll find that you can follow the story well enough.

Bluesky notes

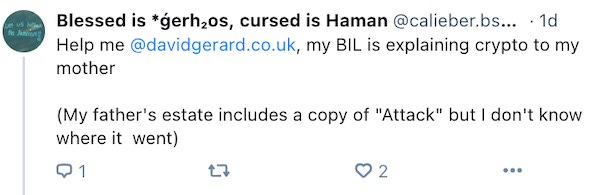

On Bluesky, one of my ersatz twitter hangouts now that the actual twitter has become a Nazi hellscape, I follow David Gerard, a prominent long-time crypto critic. His book Attack of the 50-Foot Blockchain contains a summation of his anti-crypto case.

Yesterday morning as I was waking up to my first cup of coffee of the day, I came upon a thread. A person, (“Blessed is. . .”) wrote to David asking for advice, because Blessed’s brother in law (‘BIL’) was was explaining crypto to Blessed’s widowed mother:

There then followed a brief discussion about whether or not this “BIL” was a crypto true believer, and how susceptible the mother might be to bogus pro-crypto propaganda, and the difficulty of deprogramming people who had succumbed to cultish beliefs. Gerard lamented that even after a prominent coverage of the trial and conviction of the crypto fraud and criminal Sam Bankman-Fried and revelations of the true criminal nature of an even bigger fraud called Binance, the crypto industry just hummed along:

“We just had a year of media coverage being ‘SBF is a crook’. Crypto tried to make out that the 2nd biggest exchange, FTX, was a mere aberration and everyone else was a good guy. Then the 1st biggest exchange, Binance, also got busted and so price discovery for bitcoin happens on an exchange that admitted a few months ago to being a criminal conspiracy. Point is, we literally know crypto is an unregulated mob casino, where the regulated exchanges are the cashier's desk.”

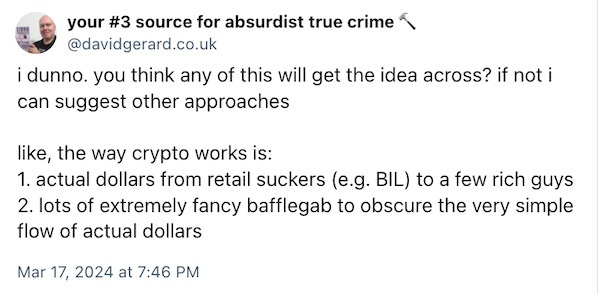

Gerard concluded his advice with the suggestion that ‘Blessed’ just use this handy distillation of the facts:

I then made the following contribution to the discussion:

To which a person calling themself ‘agent jabsco’ replied:

So I said, “Good idea, I’ll do that.” And here we are.

My crypto journey

A year and a half ago I knew virtually nothing about crypto. Then I got a job as the (freelance, contract) writer for the “Piper1” decentralized finance (‘DeFi’) project. I worked on that project between 15 and 30 hours/week from the beginning of September, 2021, through August, 2022.

Although I knew nothing about crypto when I applied for the job, I got the gig on the strength of my resume & recommendations. Also the tech lead liked the idea of somebody new to crypto coming onto the project as writer because they would see things with naive eyes, so to speak, and ask questions that would not occur to crypto veterans about stuff that confused newcomers.

I started out spending a few months drinking from the proverbial crypto/blockchain/DeFi fire hose: watching youtube videos, reading blogs & news sites & twitter feeds, taking a few online courses, studying & marking up books like Mastering Ethereum & Beginning Ethereum Smart Contracts Programming. I downloaded the PDF of the most recent version of the Solidity programming-language manual from Ethereum.org and paid $40 to Tisbury Printers to print it & bind it for me. Then I read it from the first page to the last, marking up virtually every page. Because I had no syllabus and no conceptual model, I just hopped from one topic to the next at random — liquidity pools, proof-of-work vs proof-of-stake and OpenZeppelin before lunch; yield farming, the legend of Satoshi, rug-pulls and exploits, wallets (both ‘hot’ and ‘cold’) in the afternoon.

Once I felt that I was sufficiently up to speed on smart contracts, Solidity, and DeFi I began doing code walkthroughs (by Zoom) with Piper developers. One fellow, an immigrant from India based in Texas, was a gifted teacher. The 15 or so hours of code walkthroughs that I did with him (which I recorded & rewatched) were the most enjoyable and enlightening parts of my entire time on the project.

I also regularly read the discussions in the Piper discord channel, where developers and ‘Pipernauts’ — users of the Piper app and holders of the Piper token — hung out. It took me a considerable amount of time to figure out what people were even talking about there, because the forum was largely populated by DeFi ‘degens’, (from ‘degenerate gamblers’) who communicated in the DeFi lingo. For some of these people, crypto in general and DeFi in particular seemed to be not just a full-time job or hobby, but an obsession — a religion, almost. They speak an insider’s argot.

After a month or two on the job, even as I was taking my self-designed crash course in crypto, I began to incrementally overhaul the Piper documentation — both documentation that was to be used by crypto ‘investors,’ (but see below about that word) and the documentation that was for use by software engineers. The developer documentation included both narrative and reference documentation for (A)Piper smart contracts (written in Solidity) and (B) all the tools to test, deploy, update and archive the contracts; these tools were generally written in JavaScript. And so, after 12 months of working in DeFi, I became at least somewhat conversant with both the concepts of cryptocurrency, decentralized finance, NFTs, etc, and the code that implements them.

Like everybody else at Piper, I worked remotely, from my home on Martha’s Vineyard. The only time I ever met my boss in proverbial real life was at a 'we-work'-ish kind of place near Times Square, NYC, when I happened to be in New York on personal business while he was in town for the NFT/NYC conference. Most, but by no means all, of the Piper team were Americans residing in the U.S. It is an international group.

The point of all this is that while I am not a crypto expert, I am confident that I pretty much 'get it.' And the more I learned about crypto the less I liked it (for the usual crypto-skeptic, crypto-averse, crypto-hostile reasons), and I was very relieved when I found another tech-writing gig out of cryptoland.

DAOs and fig leafs

So what exactly was (or is) Piper, the organization? Well, it turns out that that’s a little tricky to answer. In theory, Piper is a DAO, a Decentralized Autonomous Organization. The structure of the organization was set up by the founders of the project, with provisos for how the structure and function of the DAO could be modified by votes of the holders of the Piper token. Salaried people working on the project would be employed by the DAO, and the DAO would set priorities and pay salaries and handle legal matters and so forth.

If you listen to true-believers in crypto and decentralized finance, they talk about DAOs in utopian language that reminds me of how hippies talked about communes and free love in the 60’s.

In point of fact, however, the 40 or so people who worked on Piper as a full-time job were employees of “Piper Brewing Corporation” (‘PBC’), which is incorporated in the British Virgin Islands). PBC was a subsidiary of another offshore company, let’s call it Mysterious Entity, Incorporated — a company founded by a hedge fund billionaire, a software engineer who had been on the bitcoin project almost from its inception, and a third person with a background in financial technology. Venture capitalists put up much of the $$ to fund Mysterious Entity, and despite the virtual fig leaves of the PBC and so forth, the Piper ‘decentralized finance decentralized autonomous organization’ was, in actual operation, just an arm of Mysterious Entity.

In other words, despite all the utopian talk of Decentralized Autonomous Organizations, while I was employed on the Piper project, the organization functioned pretty much like any of the dozen or so other venture-funded software startups I’ve worked at. The big money people behind Mysterious Entity held enough of the Piper tokens that they could effectively run the project however they wanted.

Case in point: I was a contractor on the Piper project. At first the plan was for the DAO to vote on whether or not to hire a writer & how much to pay them. But although the DAO was fine for making so-called smart contracts, it didn’t have a mechanism for signing regular old-fashioned dumb contracts, or for paying anybody in what crypto people derisively call ‘fiat currency,’ but which you and I call ‘money.’ The Piper DAO only had a mechanism for paying somebody like me in cryptocurrency — Piper tokens, to be exact — and I was asked if I would take my pay in that form. But since my local grocery store and gas station do no accept Piper tokens as payment I insisted on being paid in dollars. In the end I was offered a contract from Mysterious Entity. I submitted my invoices to and was paid, in dollars, by Mysterious Entity, Inc. The Piper DAO was not a party to the contract.

On Tuesday of every week the ‘Piper logistics’ meeting took place. This was when members of the development and release teams got together with the marketing & business development teams and went over schedules, set priorities for product roll-outs, sync’d up front-end and back-end handshakes, and the like. Standard procedure for a software startup of this size.

Also as part of the logistics meeting, the ‘tokenomics’ guy would explain where Piper was parking its depositor’s tokens in order to earn ‘yield’ for the upcoming week. This tokenomics person was a pure degen geek, who lived and breathed nothing but DeFi protocols, projects and tokens. Every week he would load a giant spreadsheet showing yields (in annualized percent) for dozens of possible parameters. Based on his recommendations, the deployment teams would adjust the parameters of the various Piper smart contracts, all in search of greater ‘yield’ for Piper’s ‘depositors'.

Yield in the land of bafflegab

What I struggled to understand was, how was ‘yield’ calculated, and where did it come from? If I buy a government bond or a corporate bond, I pay for it in dollars, and the nominal yield is calculated in dollars and so forth. The nominal yield is just the interest that the bond issuer pays me for the loan of my money. The implicit yield on a bond is a function of its price on an exchange, and that price is set by an open market. If a town floats a bond to fund the construction of a school, for example, the market determines how trustworthy that town is, which is in some way connected to how much the people of that town care about that school. Corporate bonds, of course, are securities, subject to laws that govern such things.

Crypto tokens, according to DeFi enthusiasts, are not securities. There are no schools, or anything else, actually, at the bottom of their value chain. And since there are no securities, there are no investors. And since there are no investments, there is no interest on them. There is only yield. In search of this ‘yield’ there are all kinds of fancy ways of borrowing, lending, ‘staking’ tokens that seemed to me to be engineered to be incomprehensible.

Early on in the process of revising the documentation I became aware of the peculiar dance that I had to dance in explaining what Piper was and what Piper products were. I had to learn euphemisms and circumlocutions and where to make careful discrete omissions. I could never say ‘investor;’ I could only say ‘depositor’. I could not say ‘interest,’ I could only say ‘yield’. And so forth. This was all done in support of the fiction that Piper was not offering securities as defined by U.S. securities law.

(You may wonder, if Piper is accepting ‘deposits’ from ‘depositors,’ does that mean that Piper is actually a bank, and thus subject to banking laws? No, of course not! Let’s continue.)

Similarly, in talking about Piper’s governance, I could talk about how ‘over time’ control over the direction of the Piper project would be entirely the province of the DAO. But in describing the actual, current reality of how the current project actually worked, I could not mention the Piper Brewing Company, and certainly I should not mention that virtually everybody working on the project was paid by Mysterious Entity. It was all very hand-wavy. If you’re a technical writer by trade, as I am, you generally pride yourself on explaining things clearly, using as little jargon as possible. My job at Piper was often the opposite of that.

I should be clear that I believe that Piper is a project on the up-and-up. Unlike con artists like SBF and Do Kwon and the frauds at Tether and Celsius, the people at Piper seemed to be seriously invested in the ideals of Ethereum and DeFi. I believe that the people running the show are ethical and are working within the law as they understand it.

But it certainly was not a fun project to work on, at least it wasn’t for me. I found it a pretty disjointed operation, and after 12 months of working on it I felt like I really only knew two of my co-workers: my boss (who ran PR & Marketing for all of the parent company Mysterious Entity,), and the smart contract developer who resides in Texas and walked me through the Solidity and JavaScript code that made Piper smart contracts work.

Although I thought Piper was technically legit, I came to believe that the entire DeFi ecosystem of which Piper is a part is essentially a house of cards. More importantly, as a practical matter, DeFi as a whole functions as a giant wealth-transfer machine from the less wealthy (or, often, poor) “depositors” to the rich bag-holders.

After months of sitting in the Piper Logistics meeting and seeing how Piper’s depositor’s funds were deployed, I slowly came to understand what was meant by ‘yield’ in DeFi. Yield comes from people investing project A’s token in project B, and being rewarded with some of Project B’s token. But where does the value in Project B’s token come from? It comes from investments in Project C. And where does Project C get its value? From its investments in Project A! Each of these projects (their DAOs, so-called) ‘mints’ new tokens whenever it feels like it. None of these tokens, with the possible exception of Bitcoin, have any utility at all — except to purchase other tokens.

And what do you do, then, if you want to cash out, change your crypto into something you can actually use to say, pay your mortgage or buy some groceries? Well, you go to an exchange, which can provide you an ‘off ramp’ to the world of ‘fiat currency,’ (i.e. ‘money’) and legitimate banking. But how do you know that your exchange is legit, that it will get your capital safely out of crypto and back to the boring world of actual money?

You don’t. You don’t know from one day to the next if any given exchange is going to take your crypto & then ‘freeze withdrawals’ ‘temporarily’ due to a ‘liquidity problem’ before you can convert it to prosaic old dollars or euros.

As hard as it was for me to accept it, it turns out that all of DeFi looks pretty much just a great big game of musical chairs — a game of musical chairs full of all kinds of unsavory players. The more I understood it, the more uncomfortable I felt working in it. Not to mention that with the crypto market cratering and projects folding left and right, I had to wonder every day whether the big money people backing Piper would decide to cut their losses and pull the plug, leaving me out of a job. It was very stressful.

Some observers have remarked on how for many people, crypto is effectively a cult, with all that that implies. There’s a lot of truth in that, I believe. It’s also been said that while there are plenty of good people in crypto, the universe of DeFi is full of bad actors, and everybody who exchanges good money for crypto is potentially a victim of swindlers and thieves. I believe that that’s true too. It’s said that the only proven, non-speculative, non-gambling use case for crypto is criminal activity. About that I’ll just say ‘no comment.’

I’m glad I’m out.

Not the project’s real name.

No, I read the whole thing. Twice. So are you saying that the only thing that Piper, in particular, and crypto "projects" in general, do is to turn real world money into Internet Magic Beans, and then cover it all in bafflegab to hide the fact that what they are actually doing is stealing? I mean, you said that you felt like the people that you were working with were earnest, and on the up-and-up, but what is it that they were actually working on that had any utility that justified people paying them real money, beyond enjoyment or gambling? Because, beyond simply stealing, I can't for the life of my figure out what these "projects" actually do that a bank or a Microsoft Access database can do better, faster and cheaper in the real world.

Oh, that’s FUNNY. Piper has been posting tech writer positions all over LinkedIn and Dice for the last week. I honestly took it as that they needed a tech writer to document procedures before selling the whole mess for parts.